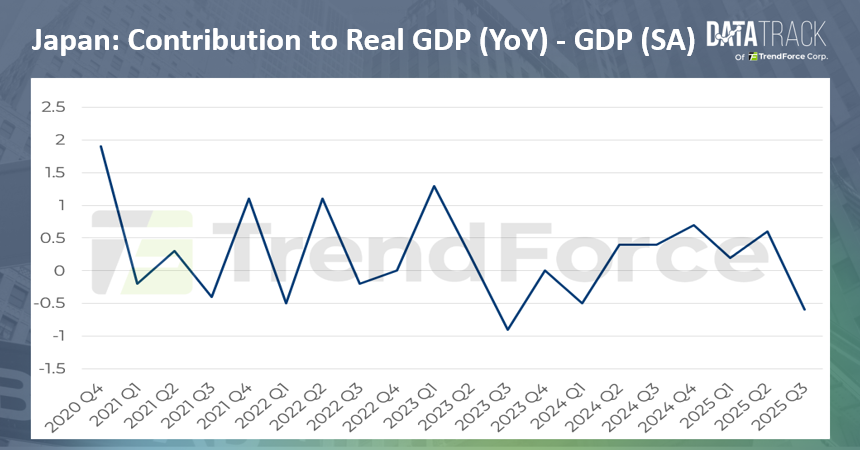

Japan’s Cabinet Office released the revised GDP figures for the third quarter of 2025 (July to September) on December 8. Real GDP contracted 0.6 percent from the previous quarter, or an annualized 2.3 percent decline, worse than the market’s median forecast of a 2.0 percent drop and the largest decrease since the third quarter of 2023. Compared with the preliminary estimates of a 0.4 percent quarterly decline and a 1.8 percent annualized drop, the revised figures indicate a sharper downturn, mainly due to weaker-than-expected corporate spending, falling exports, and reduced public investment. The impact of U.S. President Trump’s tariff policy on automobile exports is seen as another significant drag on the economy.

Breakdown data point to broad-based weakness across Japan’s economy:

- Private consumption grew only 0.1 percent, slowing from 0.4 percent in the previous quarter, affected by higher rice prices and electricity costs.

- Exports declined, pressured by U.S. tariffs and travel advisories affecting Chinese tourists.

- Public investment decreased, corporate capital expenditure fell short of expectations, and housing investment weakened due to new regulatory measures.

- Nominal GDP reached 63.582 trillion yen, slightly above the previous quarter’s 63.502 trillion yen, though real growth remained stagnant.

Overall, the revised third-quarter GDP results highlight the challenges Japan faces from external trade pressures and subdued domestic demand, signaling weakening economic momentum. In the short term (one to two months), the November economic sentiment index fell to 48.7, suggesting that exports and consumption may remain soft amid tariff effects and price pressures. Over the medium term (within six months), real GDP growth is expected to be around 0.7 percent, with private consumption and capital investment gradually recovering. However, the outlook will depend on progress in U.S.–Japan trade negotiations and the yen’s trajectory; any easing of tariff pressures would improve stabilization prospects.